–Topline results from Part A of the Phase 3 ATTRibute-CM trial of TTR stabilizer for transthyretin amyloid cardiomyopathy (ATTR-CM) expected by end of 2021

–Meaningful progress in RAS cancer portfolio with discovery of next-generation KRAS G12C dual inhibitors and novel PI3ka:RAS breakers

-Advancements in gene therapy pipeline with first patient dosed in Canavan disease trial and newly announced program targeting classic galactosemia (severe GALT deficiency)

–Company repurchased $148.4 million in BridgeBio common stock under 2021 Share Repurchase Program, demonstrating the Company’s confidence in the long-term prospects of its pipeline

–Ended quarter with $599.6 million in cash, cash equivalents and marketable securities

PALO ALTO, Calif., NOVEMBER 4, 2021 – BridgeBio Pharma, Inc. (Nasdaq: BBIO) (BridgeBio or the Company), a commercial-stage biopharmaceutical company focused on genetic diseases and cancers, today reported its financial results for the third quarter ended September 30, 2021 and provided an update on the Company’s operations.

BridgeBio has more than 30 programs in its pipeline for patients living with genetic diseases and cancers and 20 ongoing clinical trials underway across more than 450 sites around the world. Earlier this year BridgeBio received its first two U.S. Food and Drug Administration (FDA) drug approvals and has successfully filed 15 Investigational New Drug (IND) applications since the Company’s founding in 2015.

BridgeBio’s four core value drivers:

Recent pipeline progress and corporate updates:

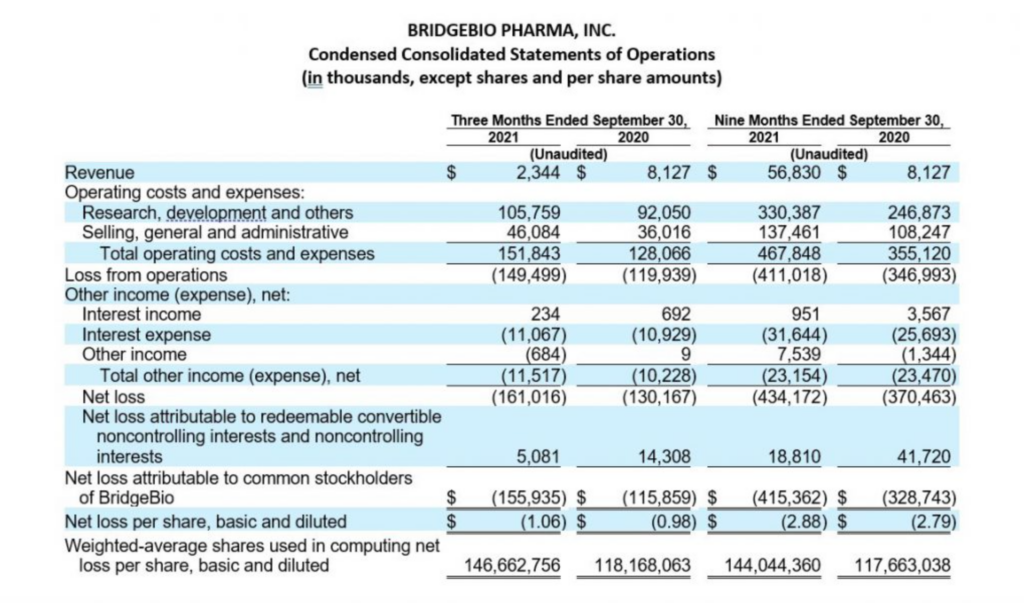

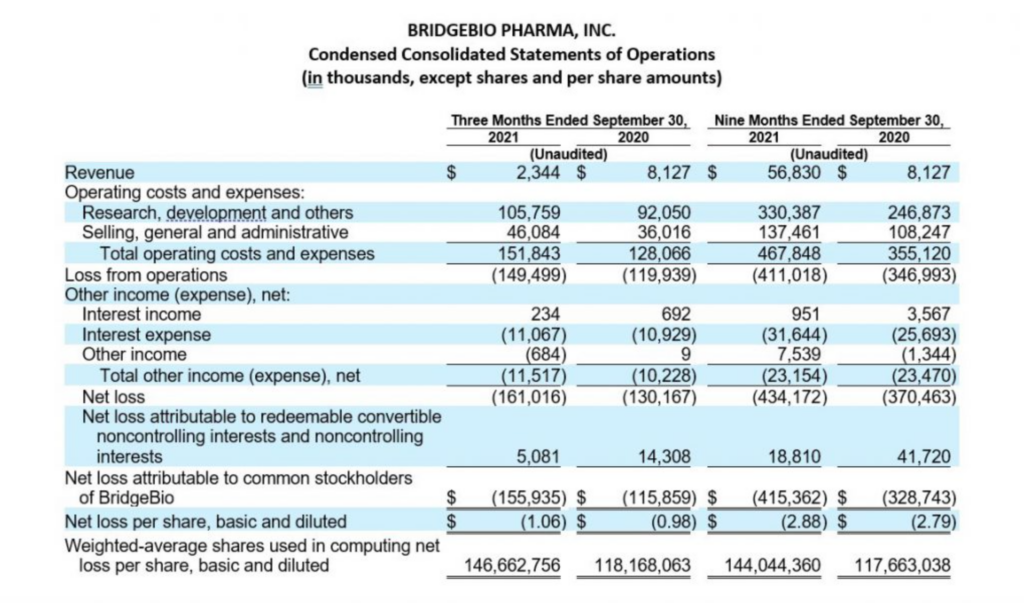

Third Quarter 2021 Financial Results:

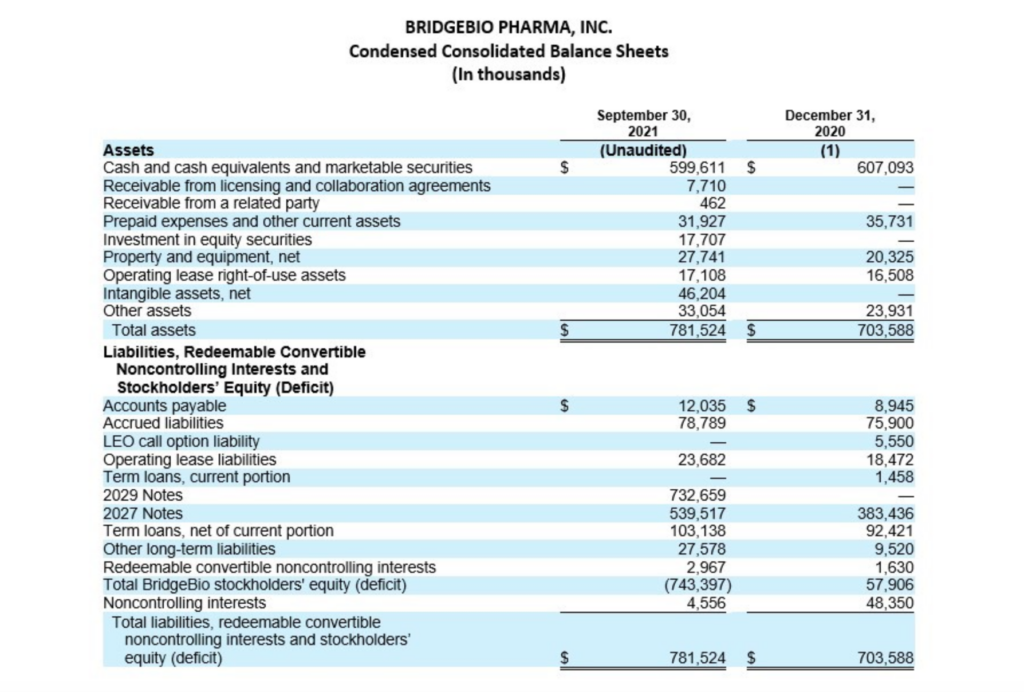

Cash, Cash Equivalents and Marketable Securities

Cash, cash equivalents and marketable securities, excluding restricted cash, totaled $599.6 million as of September 30, 2021, compared to $607.1 million as of December 31, 2020. Over the past three quarters, the Company repurchased $148.4 million in BridgeBio common stock under its 2021 Share Repurchase Program and $50.0 million in BridgeBio common stock in conjunction with its issuance of the 2029 convertible notes, paid $61.3 million for capped call options related to the issuance of its 2029 convertible notes and $35.0 million of regulatory-related milestone payments in connection with its approved products. Earlier during the year, BridgeBio paid $21.3 million to Eidos shareholders who elected for cash settlement in exchange for their Eidos shares and $63.8 million of direct transaction costs arising from the merger with Eidos. These were offset by cash receipts of $731.4 million in net proceeds from the issuance of BridgeBio’s 2029 convertible notes, $65.1 million from collaboration partner, Helsinn Group, and $25.0 million in net proceeds from Hercules Capital, Inc. under an amended loan agreement. The remaining change primarily related to payments of interest and operating costs and expenses.

Cash, cash equivalents and marketable securities, excluding restricted cash decreased by $298.8 million when compared to balance as of June 30, 2021, which was $898.4 million. During the quarter, the Company repurchased $143.1 million of BridgeBio common stock and paid $35.0 million of regulatory-related milestone payments in connection with its approved products.

Operating Costs and Expenses

Operating costs and expenses for the quarter increased by $23.7 million to $151.8 million in the current quarter as compared to $128.1 million for the same period in the prior year. The increase in operating costs and expenses was due to an increase in personnel and external costs to support the progression in BridgeBio’s research and development programs and staged buildout of its commercial organization as part of commercial launch readiness activities. This increase in personnel and external costs was offset by $12.2 million in reimbursement of expenses from the cost sharing arrangement recognized under BridgeBio’s License and Collaboration Agreement with Helsinn Group. Stock-based compensation for the quarter was $16.1 million as compared to $17.7 million for the same period in the prior year.

The Company’s research and development expenses have not been significantly impacted by the global COVID-19 pandemic for the periods presented. While BridgeBio experienced some delays in certain of its clinical enrollment and trial commencement activities, it continues to adapt in this unprecedented time to enable alternative site, telehealth and home visits, at-home drug delivery, as well as mitigation strategies with its contract manufacturing organizations. The longer-term impact, if any, of COVID-19 on BridgeBio’s operating costs and expenses is currently unknown.

About BridgeBio Pharma, Inc.

BridgeBio Pharma, Inc. (BridgeBio) is a biopharmaceutical company founded to discover, create, test and deliver transformative medicines to treat patients who suffer from genetic diseases and cancers with clear genetic drivers. BridgeBio’s pipeline of over 30 development programs ranges from early science to advanced clinical trials and its commercial organization is focused on delivering the company’s two approved therapies. BridgeBio was founded in 2015 and its team of experienced drug discoverers, developers and innovators are committed to applying advances in genetic medicine to help patients as quickly as possible. For more information visit bridgebiodev.wpengine.com and follow us on LinkedIn and Twitter.

BridgeBio Pharma, Inc. Forward-Looking Statements

This press release contains forward-looking statements. Statements in this press release may include statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements, including statements relating to the clinical and therapeutic potential of our programs and product candidates, including our four core value drivers, the availability and success of topline results from Part A and Part B of our Phase 3 ATTRibute-CM trial of acoramidis, our plans to submit an application for regulatory approval of acoramidis, the availability and success of additional data from our ongoing study of encaleret for ADH1, the timing and success of additional trials of encaleret for ADH1, the availability and success of initial data from our ongoing Phase 2 study of low-dose infigratinib for achondroplasia and our ongoing Phase 1/2 study of BBP-631 for CAH, our faith in the long-term prospects of our pipeline, the success of our continuing partnership with LianBio, the timing of our selection of a RAS development candidate, the timing and success of our Phase 1/2 trial of BBP-812 for Canavan disease, the ability of BBP-812 to be the first approved therapeutic option for children born with Canavan disease, the ability of BBP-418 to be the first approved therapy for patients with LGMD2i, the timing and success of the Phase 2 trial of BBP-418 in patients with LGMD2i, the availability and success of final data from our ongoing Phase 1 study of BBP-711 for the treatment of PH1, the timing and success of additional clinical trials of BBP-711 in PH1 and in recurrent kidney stone formers, our eligibility to receive future royalty payments under our strategic collaboration with the Helsinn Group and the timing of these events, as well as our anticipated cash runway, reflect our current views about our plans, intentions, expectations and strategies, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations and strategies as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a number of risks, uncertainties and assumptions, including, but not limited to, initial and ongoing data from our preclinical studies and clinical trials not being indicative of final data, the potential size of the target patient populations our product candidates are designed to treat not being as large as anticipated, the design and success of ongoing and planned clinical trials, future regulatory filings, approvals and/or sales, despite having ongoing and future interactions with the FDA or other regulatory agencies to discuss potential paths to registration for our product candidates, the FDA or such other regulatory agencies not agreeing with our regulatory approval strategies, components of our filings, such as clinical trial designs, conduct and methodologies, or the sufficiency of data submitted, the continuing success of our collaborations, potential volatility in our share price and its impact on our 2021 Share Repurchase Program, potential adverse impacts due to the global COVID-19 pandemic such as delays in regulatory review, manufacturing and supply chain interruptions, adverse effects on healthcare systems and disruption of the global economy, as well as those risks set forth in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2020, and our other filings with the U.S. Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment in which new risks emerge from time to time. These forward-looking statements are based upon the current expectations and beliefs of our management as of the date of this press release, and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Except as required by applicable law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

BridgeBio Media Contact:

Grace Rauh

[email protected]

(917) 232-5478

BridgeBio Investor Contact:

Katherine Yau

[email protected]

(516) 554-5989