BridgeBio Pharma, Inc. Reports Fourth Quarter And Full Year 2020 Financial Results And Business Update

–Completed acquisition of Eidos Therapeutics, allowing BridgeBio to deploy its full clinical and commercial infrastructure to develop and plan for potential global commercialization upon regulatory approval of Eidos’ product candidate, acoramidis, a potential best-in-class therapy for patients with amyloidosis cardiomyopathy (ATTR-CM)

–New Drug Application (NDA) for infigratinib for the treatment of cholangiocarcinoma accepted by the U.S. Food and Drug Administration (FDA) under Priority Review designation and Real-Time Oncology Review (RTOR) pilot program, designed to expedite the delivery of safe and effective cancer treatments to patients

–Initiated two new clinical trials since last quarterly update and progressed additional 17 ongoing clinical trials

–Ended quarter with $607.1 million in cash, cash equivalents and marketable securities before issuance of 2.25% Convertible Senior Notes in February 2021, which raised nearly $750 million in gross proceeds

PALO ALTO, Calif., FEBRUARY 25, 2021 – BridgeBio Pharma, Inc. (Nasdaq: BBIO) (BridgeBio or the Company), a clinical-stage biopharmaceutical company founded to discover, create, test and deliver meaningful medicines for patients with genetic diseases and cancers with clear genetic drivers, today reported its financial results for the fourth quarter and full year ended December 31, 2020 and provided an update on the Company’s operations.

Since its last quarterly update, BridgeBio completed its acquisition of Eidos Therapeutics, Inc. (formerly Nasdaq: EIDX) (Eidos) in January 2021, acquiring all of the outstanding shares of Eidos common stock that BridgeBio did not already own. The merger returns BridgeBio and Eidos to a single unified company and is intended to allow BridgeBio to unlock the full potential of acoramidis, a potential best-in-class therapy for patients with transthyretin (TTR) amyloidosis (ATTR).

Acoramidis for ATTR is one of BridgeBio’s four core value driver programs along with encaleret (CaSR inhibitor) for autosomal dominant hypocalcemia type 1 (ADH1), low-dose infigratinib (FGFR inhibitor) for achondroplasia, and BBP-631, an AAV5 gene therapy for congenital adrenal hyperplasia (CAH). Pivotal or potential proof-of-concept data is anticipated for each of the programs by the end of 2021 or early 2022.

BridgeBio had its second NDA accepted by the FDA and is preparing for its first two commercial launches this year, pending FDA approval, for infigratinib for the treatment of cholangiocarcinoma (CCA), or bile duct cancer, as a second-line or later therapy in patients with advanced and/or metastatic CCA with FGFR2 fusions or translocations, and for fosdenopterin for the treatment of MoCD Type A, an ultra-rare, life-threatening genetic disorder that results in severe and largely irreversible neurological injury for infants and children. Additionally, the Company initiated two new clinical trials and progressed 17 additional ongoing trials. BridgeBio established a joint venture with Maze Therapeutics to advance precision medicine to treat cardiovascular disease and entered into a partnership agreement with the University of California, San Francisco to drive the advancement of academic innovations in genetically driven diseases into potential therapeutics for patients.

“We are hopeful that the scientific innovation we are pursuing at scale begins to translate into meaningful gains for patients this year. We are on track to deliver near-term pivotal or potential proof-of-concept data in our four core value driver programs. The successful completion of our acquisition of Eidos allows us to further focus BridgeBio’s clinical and commercialization engine on acoramidis for patients suffering from ATTR,” said BridgeBio CEO and founder, Neil Kumar, Ph.D. “We are also starting the year in a strong financial position following our recent debt financing, which enables us to progress the 19 ongoing clinical trials and over 30 programs in our pipeline, as well as to prepare for the anticipated launch of our first two drugs, if approved.”

Major milestones anticipated in 2021 or early 2022 for BridgeBio’s four core value drivers:

- Acoramidis (AG10) – TTR stabilizer for ATTR-CM: Topline results from Part A of the ATTRibute-CM trial are expected in late 2021 or early 2022 and from Part B in 2023. If Part A is successful, BridgeBio expects to submit an application for regulatory approval of acoramidis in 2022. ATTR is a form of amyloidosis caused by the accumulation of misfolded TTR protein. It is estimated to affect more than 400,000 people in the United States and the European Union and is largely undiagnosed today.

- Encaleret – calcium-sensing receptor (CaSR) inhibitor for ADH1: Early results from an ongoing Phase 2 proof-of-concept study will be shared at the Endocrine Society’s 2021 Annual Meeting (ENDO) on March 20th. If the development program is successful, encaleret could be the first approved therapy for ADH1, a condition caused by gain of function variants in the CaSR gene estimated to be carried by 12,000 individuals in the United States alone.

- Low-dose infigratinib – FGFR1-3 inhibitor for achondroplasia: Initial data from the ongoing Phase 2 dose ranging study are expected in the second half of 2021. Achondroplasia is the most common form of genetic short stature and one of the most common genetic diseases, with 55,000 cases in the United States and European Union. Low-dose infigratinib is the only known product candidate in development for achondroplasia that targets the disease at its genetic source and the only orally administered product candidate in clinical-stage development.

- BBP-631 – AAV5 gene therapy candidate for CAH: Initiation of a first-in-human Phase 1/2 study is expected in the second half of 2021, with initial data anticipated in late 2021 or early 2022. CAH is one of the most prevalent genetic diseases potentially addressable with AAV gene therapy, with more than 75,000 cases in the United States and European Union. The disease is caused by deleterious mutations in the gene encoding an enzyme called 21-hydroxylase, leading to lack of endogenous cortisol production. BridgeBio’s AAV5 gene therapy candidate is designed to provide a functional copy of the 21-hydroxylase-encoding gene (CYP21A2) and potentially address many aspects of the disease course.

Recent pipeline progress and corporate updates:

- Completed acquisition of Eidos Therapeutics in January 2021, acquiring of all of the outstanding shares of Eidos common stock that BridgeBio did not already own. The merger returns Eidos to BridgeBio’s vibrant ecosystem of innovation and is intended to allow BridgeBio to deploy its full clinical and commercial infrastructure to support the development and global commercialization plans underway for Eidos’ product candidate, acoramidis, a potential best-in-class therapy for patients with ATTR-CM.

- Raised nearly $750 million in gross proceeds in February 2021 through issuance of 2.25% Convertible Senior Notes due in 2029. The Company expects current cash, cash equivalents and marketable securities to support its planned operations into 2023.

- NDA accepted by the FDA for infigratinib, an oral FGFR1-3 selective inhibitor, for individuals with CCA as a second-line or later therapy in patients with advanced and/or metastatic CCA with FGFR2 fusions or translocations. The NDA has been granted Priority Review designation and is being reviewed under the Real-Time Oncology Review (RTOR) pilot program. BridgeBio has also submitted for regulatory review in Australia and Canada under Project Orbis, an initiative of the FDA’s Oncology Center of Excellence that allows for concurrent submission and review of oncology drugs among participating international regulatory agencies.

- BBP-681 – Topical PI3Ka inhibitor for venous malformations (VMs), lymphatic malformations (LMs), and venolymphatic malformations (VLMs) associated with PIK3CA or TEK mutations: Dosed first patient in Phase 1/2 clinical trial.

- BBP-398 – SHP2 inhibitor for tumors driven by RAS and receptor tyrosine kinase mutations: Dosed first patient in Phase 1 clinical trial.

- Established Contour Therapeutics, a joint venture between BridgeBio and Maze Therapeutics, focused on transforming and advancing breakthrough precision medicine approaches designed to treat cardiovascular disease, the leading cause of death worldwide.

- Established collaboration agreement with the University of California, San Francisco to advance the discovery of therapies for genetically driven diseases.

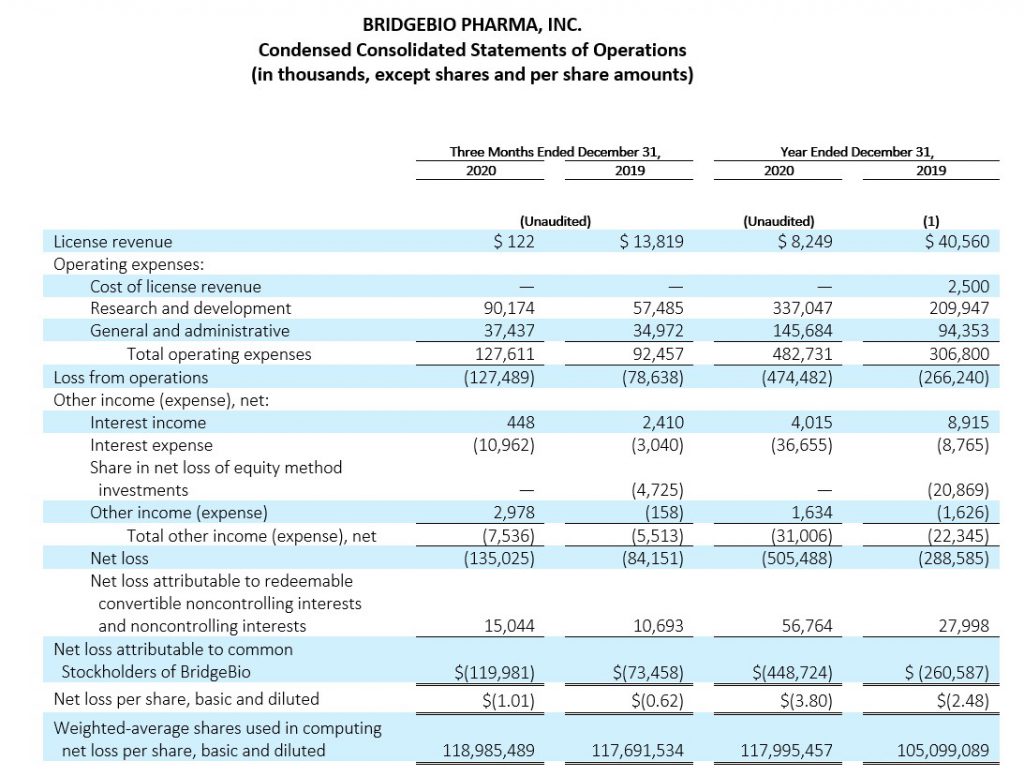

Fourth Quarter and Full-Year 2020 Financial Results:

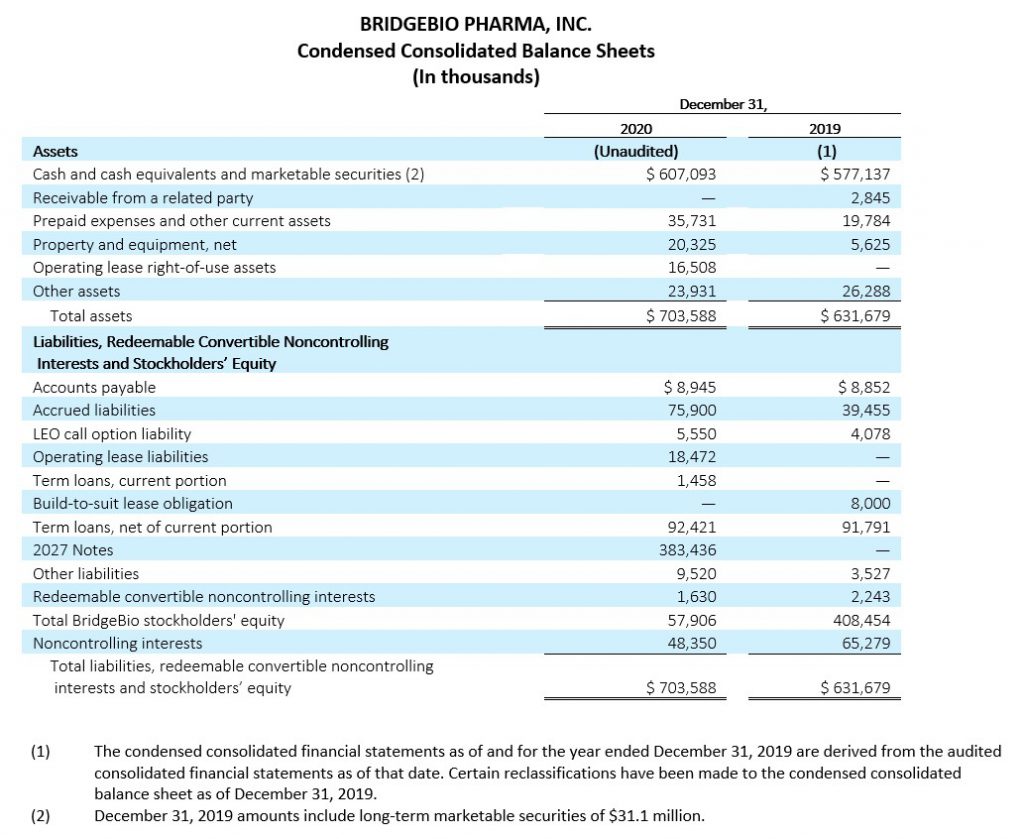

Cash, Cash Equivalents and Marketable Securities

Cash, cash equivalents and marketable securities, excluding restricted cash, totaled $607.1 million as of December 31, 2020, compared to $577.1 million as of December 31, 2019. The net increase in cash balance of $30.0 million reflects $537.0 million in net proceeds received from the issuance of our 2.50% Convertible Senior Notes due 2027 (2027 Notes), $24.1 million in net proceeds received from Eidos’ at-the-market issuance of shares, offset by payment of $75.0 million to repurchase BridgeBio shares in capped call transactions in connection with the issuance of our 2027 Notes, $49.3 million payment related to capped call option, $15.3 million payments of interest on our debts, and $391.5 million primarily related to operating expenses.

Cash, cash equivalents and marketable securities, excluding restricted cash, totaled $710.7 million as of September 30, 2020, resulting in a decrease of $103.6 million as compared to December 31, 2020. The decrease in cash reflects $2.0 million payments of interests on our debts and $109.6 million primarily relating to operating expenses, partially offset by a receipt of $8.0 million in upfront payment under the license agreement with LianBio.

Operating Expenses

Operating expenses for the three months and year ended December 31, 2020 were $127.6 million and $482.7 million, respectively, as compared to $92.5 million and $306.8 million, respectively, for the same periods in the prior year. The increases in operating expenses of $35.1 million and $175.9 million during the respective periods were attributable to the increase in external-related costs, including manufacturing validation activities for our late-stage programs, and increase in personnel costs resulting from an increase in the number of employees to support the progression in our research and development programs, including our increasing research pipelines, and overall growth of our operations.

Operating expenses for the three months ended December 31, 2020 decreased by $0.5 million when compared to the operating expenses for the three months ended September 30, 2020 of $128.1 million.

Our research and development expenses have not been significantly impacted by the global outbreak of COVID-19 for the periods presented. While we experienced some delays in certain of our clinical enrollment and trial commencement activities, we continue to adapt in this unprecedented time to enable alternative site, telehealth and home visits, at-home drug delivery, as well as mitigation strategies with our contract manufacturing organizations. The longer-term impact of COVID-19 on our operating expenses is currently unknown.

About BridgeBio

BridgeBio is a team of experienced drug discoverers, developers and innovators working to create life-altering medicines that target well-characterized genetic diseases at their source. BridgeBio was founded in 2015 to identify and advance transformative medicines to treat patients who suffer from Mendelian diseases, which are diseases that arise from defects in a single gene, and cancers with clear genetic drivers. BridgeBio’s pipeline of over 20 development programs includes product candidates ranging from early discovery to late-stage development.

BridgeBio Pharma Forward-Looking Statements

This press release contains forward-looking statements. Statements we make in this press release may include statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements, including statements relating to expectations, plans and prospects regarding the preclinical and clinical development plans, clinical trial designs, clinical and therapeutic potential, and strategy of our product candidates, including, but not limited to: the unknown future impact of the COVID-19 pandemic delay on certain clinical trial milestones and/or our operations or operating expenses; uncertainty of the expected financial performance of each of us and Eidos following completion of the merger, including the possibility that the expected synergies and value creation from the merger will not be realized or will not be realized within the expected time period; the timing and success of our planned preclinical and clinical development of our development programs, and the timing and success of any such continued preclinical and clinical development and planned regulatory submissions, including for each of acoramidis, infigratinib, BBP-631 and encaleret; the potential therapeutic and clinical benefits of each of acoramidis, infigratinib, BBP-631 and encaleret; the potential size of the target patient populations for each of acoramidis, infigratinib, BBP-631 and encaleret; the timing and approval for commercialization this year for each of infigratinib for the treatment of cholangiocarcinoma and fosdenopterin for the treatment of MoCD Type A; the number of potential medicines in our portfolio; the success of our joint venture with Maze Therapeutics through Contour Therapeutics, our partnership with the University of California, San Francisco, and our other collaboration agreements with various academic institutions; our ability to produce meaningful medicines; the potential for encaleret to be the first approved therapy for ADH1; our expected runway for cash, cash equivalents and marketable securities; our ability to advance infigratinib through the Real-Time Oncology Review pilot program and under Project Orbis; the timing and success of our Phase 1/2 clinical trial of BBP-681; the timing and success of our Phase 1 clinical trial of BBP-398; and the timing of these events, reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a number of risks, uncertainties and assumptions, including, but not limited to: the success of clinical trials, regulatory filings, approvals and/or sales; despite having ongoing interactions with the FDA or other regulatory agencies, the FDA or such other regulatory agencies may not agree with our regulatory approval strategies, components of our filings, such as clinical trial designs, conduct and methodologies, or the sufficiency of data submitted; potential adverse impacts due to the global COVID-19 pandemic such as delays in regulatory review, manufacturing and supply chain interruptions, adverse effects on healthcare systems and disruption of the global economy; and those risks set forth in the Risk Factors section of our most recent quarterly or annual periodic report filed with the SEC and our other SEC filings. In addition, the information contained in this release and the condensed consolidated balance sheet information is unaudited and does not present all information necessary for an understanding of the Company’s financial condition as of December 31, 2020 and its results of operations for the three months and year ended December 31, 2020. Moreover, BridgeBio operates in a very competitive and rapidly changing environment in which new risks emerge from time to time. These forward-looking statements are based upon the current expectations and beliefs of BridgeBio’s management as of the date of this release and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Except as required by applicable law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact:

Grace Rauh

[email protected]

(917) 232-5478